Current State of E-commerce Development in Southeast Asia

Southeast Asia stands out as one of the fastest-growing regions in the global e-commerce market, with a projected value reaching $172 billion by 2025. The region boasts substantial consumer power, a high demographic dividend, and rapid internet development. In this article, we will explore the current e-commerce landscape in some countries of Southeast Asia for this year.

Indonesia Issues Ban on Social E-Commerce

On the 27th of last month, the Ministry of Trade of the Republic of Indonesia announced the official enforcement of revised online trade regulations, which effectively prohibits social media platforms, including short video platforms, from conducting e-commerce activities. This means Indonesian users are no longer allowed to buy or sell products and services on social media platforms like TikTok and Facebook. Zulkifli Hasan, the Minister of Trade of the Republic of Indonesia, stated, "It is necessary to separate social media from e-commerce so that algorithms are not entirely controlled, preventing personal data from being commercially exploited." Indonesia also expressed its intention to regulate the sale of overseas goods on online platforms and indicated that these goods would be treated similarly to domestically produced Indonesian goods.

Malaysia Emerges as a Hotspot for Southeast Asian E-Commerce

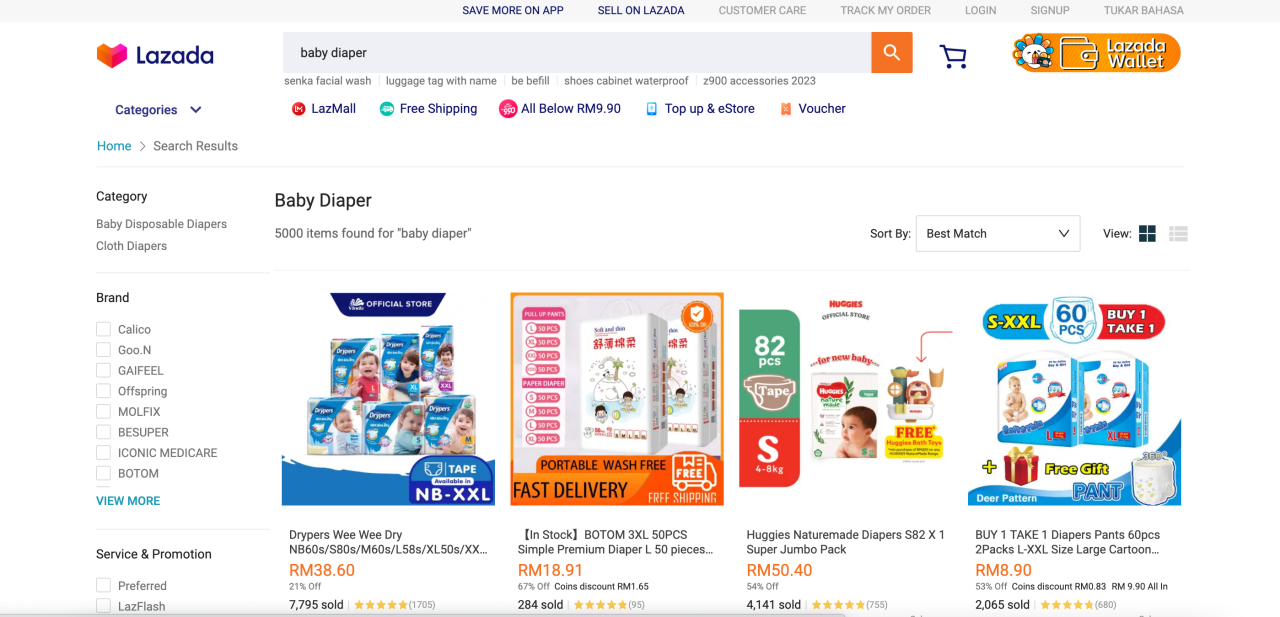

In Southeast Asia, there is another country with a market share just below Indonesia but experiencing rapid growth – Malaysia. Malaysia is the third-largest economy in Southeast Asia and the 35th largest e-commerce market globally. According to predictions, the growth rate of the e-commerce market in Malaysia is projected to be 18.8% from 2019 to 2025, far exceeding the global average of 11%. Lazada is one of the largest e-commerce platforms in Malaysia, with baby and maternity products consistently being top-selling categories on the Lazada platform. Among them, diapers are particularly popular on the Malaysian site, constituting 5% of the total diaper sales in Malaysia, according to data from Lazada.

Overall, Malaysia's e-commerce outlook appears promising with both government support and consumer preference for digital payments. Additionally, Malaysia has a youthful population with an internet penetration rate of 85%, accounting for approximately 26 million people. About 80% of them choose to shop online, and among these online shoppers, 93% opt for digital payment methods such as Alipay, WeChat Pay, Google Pay, and PayPal. Concurrently, the Malaysian government actively promotes the development of e-commerce, including efforts to expand internet coverage to more rural areas and enhance electronic wallet technology services.

While the diaper market in Southeast Asia is approaching saturation, the addition of sales channels has somewhat mitigated market saturation. E-commerce platforms serve as a stepping stone for new brands to enter the market. Therefore, Jiayue suggests that there is still great potential in the Malaysian market. Seizing the opportunity during the second half of the year, especially in peak seasons, is advisable. Jiayue has already assisted many clients in Southeast Asia in becoming locally recognized brands. Feel free to contact us for more details!Whatsapp/Tel/Wechat: 0086 15980308853