A Major Strike Erupts at U.S. Ports! Causing a Surge in Pulp Prices and Shipping Costs

Recently, several major U.S. ports have experienced large-scale strikes, severely disrupting global supply chains, particularly having a profound impact on the hygiene products industry. This disruption threatens the import of raw materials and significantly affects the export of company products. Additionally, the strike has worsened shipping congestion, causing an imbalance between container supply and demand, making it difficult to meet the capacity needs of international ports, thus placing immense pressure on the global supply chain. This strike could lead to a series of ripple effects, including rising pulp prices and soaring shipping costs.

First, pulp is one of the main raw materials for hygiene product manufacturing, and since the U.S. is a key global pulp exporter, the port strikes will directly impact pulp exports, leading to further supply shortages. Due to limited global pulp inventories, this event may cause a supply-demand imbalance, pushing up pulp prices and increasing the production costs for items such as tissues, diapers, and sanitary pads. Secondly, the strikes may lead to a sharp increase in shipping costs. In recent years, global logistics have already faced challenges with capacity shortages and delays due to the pandemic, and U.S. ports, as critical nodes in the global supply chain, will see exacerbated bottlenecks and delays due to the strikes, thus increasing transportation costs, especially for companies that rely heavily on imported raw materials or exported products.

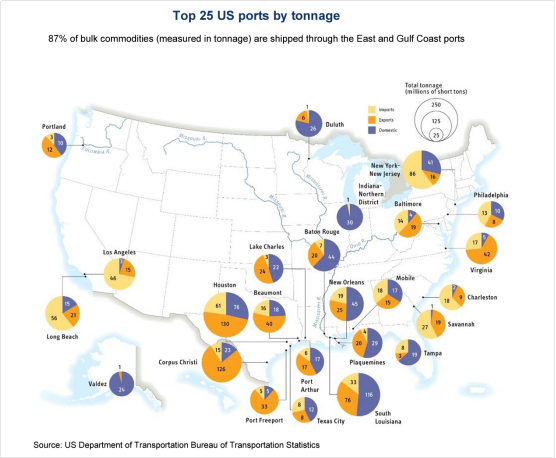

Moreover, the strikes will not only affect the U.S. domestic market but may also have global economic repercussions. As the world’s largest economy, a paralysis of U.S. ports could hinder the smooth flow of global goods, further affecting the supply chain security of other countries. According to data from the U.S. Chamber of Commerce, the 36 ports impacted by the strike handle 57% of the country’s international container traffic and 87% of its goods trade (by tonnage). In this context, Jiayue suggests taking proactive measures such as stocking up in advance and adjusting supply chains to minimize the negative impact of the U.S. port strikes.