Is Ocean Freight Still Plummeting? European and US Routes Continue to Plummet, while Middle East Red Sea Routes Rebound to the Upside

Is Ocean Freight Still Plummeting? European and US Routes Continue to Plummet, while Middle East Red Sea Routes Rebound to the Upside

Recently, shipping lines have continued to cancel voyages from China to Northern Europe and the Western United States to slow the decline in spot container rates. However, despite a sharp increase in the number of light sailings, there appears to be little impact on shippers’ access to shipping space and the downward trend in freight rates remains unchecked.

According to the latest data from the major shipping indices, there is no slowing trend in the decline of rates in the Western United States and the market continues to weaken, suggesting that rates in Western United States could drop to around US$1,500 in 2019 in the coming weeks. According to feedback, in fact, the market is already quoted at US$1,500.

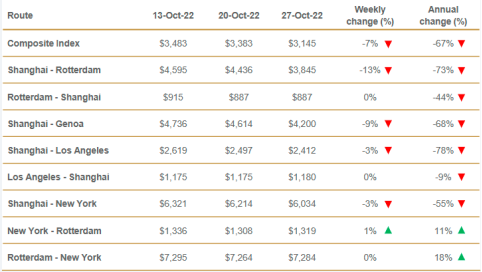

The latest Drewry WCI composite index fell by 7% week-on-week and has declined for 35 consecutive weeks. This represents a 67% decline compared to the same period last year. After consecutive double-digit weekly declines, the rate of decline has narrowed since the beginning of October. However, the current 7% decline was the greatest in October.

Analysis of the Latest Major Freight Indices

North American routes: According to data released by Markit, the preliminary value of the US Markit manufacturing PMI for October was 49.9, a new low since June 2020 and below market expectations. During this period, the transport market performed poorly, with sluggish growth in transport demand and a weakening of supply and demand, extending the downward trend in market rates.

South America routes: (Santos) rate of US$4,541/TEU, a weekly decline of US$518 or 10.24%.

Persian Gulf routes: The route has performed relatively well recently, with cargo volumes remaining stable overall and some carriers continuing to control capacity allocation, which has supported market rates to continue to rise in the current period. The freight rate of the Persian Gulf routes was US$1,727/TEU, an increase of US$276 per week, or 19.02%.

Southeast Asia routes: (Singapore) freight rate of US$346 per container, a decline of US$6 per week, or 1.70%. Some routes showed an upward trend, including Thailand-Vietnam routes, where freight rates rose 193.8% compared with last week.

Middle East routes: Liner companies curtailed the available market capacity by means of temporary suspensions and liner merging, which led to a tight supply of shipping space on the routes and a sharp rise in spot market booking prices. The Middle East Shipping Line Index was 1853.8 points, rising 45.4% compared with last week.

African routes: Suez Canal Authority (SCA) has issued a new announcement stating that tolls for tankers and other vessels travelling through the Suez Canal will increase by 15 per cent and tolls for dry cargo vessels and sightseeing cruises by 10 per cent from New Year's Day 2023.

According to the person in charge of a large shipping agency, the freight rate, which had stabilized a little in the last period, has fallen more this period, which is primarily due to the successive delivery of large vessels of 10,000 containers by shipping companies. At present, in addition to the significant reduction in the volume of electronic products, the market is actually increasing in the livelihood of goods. The market will enter the off-season in the next two months, and freight rates are likely to continue to fall, and it is estimated that about a month before the Lunar New Year, there may be a chance to see a halt to the decline, or even rebound.

So now is the best opportunity to import and export diaper, Jiayue standard and customized baby/adult/pet diaper, wet/dry wipes, sanitary napkins, under pad, and raw materials. We have a steady monthly export volume; we have a wealth of experience in exporting and brand development which has helped our customers to become well known locally. We can afford to take on large orders and guarantee a consistent quality output, and we are equally able to deliver on time during the COVID-19 outbreak. We look forward to your cooperation with us!